Smart Payment Solutions for Every Business

Simplify your transactions with tailored credit card processing and point of sale systems designed for your unique business. From in-store to online, we make accepting payments easy, secure, and reliable.

Let's Get Started

Not sure where to start? Call us and our merchant services experts will guide you to the perfect solution that meets your needs.

Service. Savings. Solutions

At our core, we specialize in delivering flexible and reliable credit card processing and point of sale (POS) systems tailored to businesses of all types and sizes. Whether you’re operating a retail store, running a mobile business, or managing an online shop, we provide the tools you need to accept payments with ease. Our services include customized solutions for POS systems, credit card terminals, mobile payments, and e-commerce payment processing. We take the time to understand your unique business needs and connect you with a dedicated merchant services specialist to ensure a seamless, efficient setup. Let us help you streamline transactions and grow with confidence.

Comprehensive Payment Solutions for Every Business

From in-store to online, we offer secure, scalable payment processing systems tailored to your business needs. Explore advanced POS options, mobile payments, virtual terminals, and more—all in one place.

Home

HomeClover Family

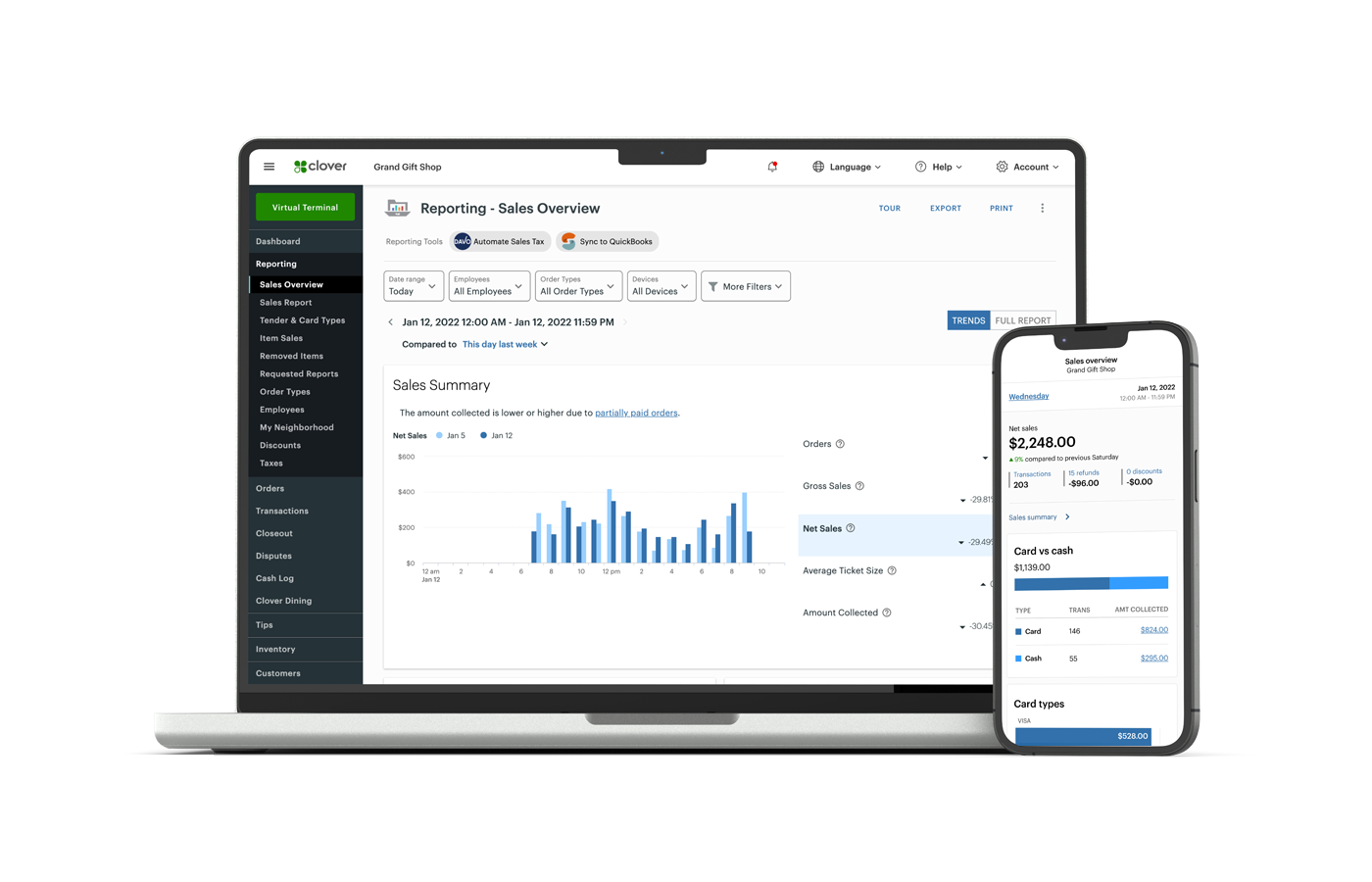

Clover is a powerful, all-in-one POS system that adapts to the way you do business. It allows you to accept all major payment types, manage inventory, run reports, and track sales in real time. Whether you’re operating a retail shop, restaurant, or service-based business, Clover offers flexible plans and devices that grow with you.

Home

HomeCardPointe Suite

CardPointe is a complete, cloud-based payment platform that makes accepting and managing payments simple and secure. It integrates seamlessly with your business operations—online, in-store, or by invoice—eliminating the need for multiple systems. With advanced security features and real-time reporting, you can manage your transactions with ease and confidence.

Home

HomeWireless & Mobile

Our wireless and mobile POS systems give you the freedom to accept payments anywhere, anytime. With support for WiFi and 5G, you’re always connected—and with “store-and-forward” functionality, you can even process payments without a signal. It’s the perfect solution for food trucks, service calls, outdoor events, and more.

Home

HomeStand Alone Terminals

Our stand-alone terminals provide a simple, reliable way to accept credit card payments without the complexity of a full POS system. These devices support chip, swipe, and contactless transactions, making them ideal for quick-service environments. Easy to set up and use, they’re built for speed, security, and convenience.

Home

HomeE-Commerce & Virtual

Our e-commerce and virtual terminal solutions allow you to accept payments securely from anywhere. Whether you’re invoicing clients or managing an online store, you can process credit card payments right from your computer or smart device. It’s a flexible option for remote teams, service providers, and digital businesses.

Home

HomeAgent and ISO Program

Our Agent and ISO Program offers everything you need to grow your merchant services business with confidence. From competitive payouts and full access to our payment solutions, to white-label marketing support, we empower you to close deals faster and build lasting client relationships. Join our team and elevate your success.

Home

HomeZero Cost Processing

Zero Cost Processing helps you eliminate credit card processing fees by passing them on to customers legally and transparently. Choose from our Cash Discount or Surcharge Programs to keep more of your profits while remaining compliant. It’s a smart, cost-effective solution that protects your bottom line.

Local Support

Whether you have questions about your merchant services account, need help setting up your payments device/POS system, or you want us to train your staff, New Era Merchant Services is here!

Fraud/Chargeback Protection

EMV Pos Integration

Cloud-Based

Every New Era Merchant Services account comes with access to our industry leading Cloud-Based management tools. Access data manage your business and evaluate statistics from anywhere in the world.

The Good Payment Merchant Services Advantage

No Contracts

Our excellent customer service and low rates retain customers, not contracts. Cancel anytime but we bet you won’t want to.

Free POS Equipment

Get free Point-of-Sale systems and terminals with qualifying plans — tailored to fit your business without extra cost.

Personalized Agent Support

Your dedicated specialist is just a call or text away — no generic hotlines, just real people helping your business grow.

Transparent Pricing

Our pricing is straightforward — no hidden fees or surprise rate hikes. You’ll always know what to expect.

Long Time Supportive Active Member Of The Local Community

Benefits of Working With Us

Fast Funding

We offer Next Day and Same Day funding options so you can keep your cash flow healthy and access your earnings when you need them most.

Customized POS Systems

Whether you run a retail store, mobile setup, or e-commerce site, our POS solutions are tailored to your specific business model — smart, simple, and scalable.

Clear & Honest Pricing

Forget hidden fees and confusing rates. Our pricing is upfront, competitive, and consistent — designed to support your bottom line, not surprise you.

Business-Building Extras

From gift cards and loyalty programs to business loans and ACH payments, we provide added tools that help your business grow, engage, and succeed.

What Separates Us From The Competition?

No Contracts

Instant & Next Day Funding

24/7 Support

Call, email, or chat. Our credit card processing team is standing by 24/7.

Solutions For All Types Of Payments

Contact Info

Location

1776 N Scottsdale Road #8252

Scottsdale, Arizona 85252

Phone

Flexible Payment Solutions to Power Your Business

Whether you’re at the counter, on the go, or selling online, we provide the right tools to accept payments with ease. Discover a full suite of POS systems and processing solutions built to grow with you.

Clover Family

CardPointe Suite

Wireless & Mobile

Our wireless and mobile POS systems are designed for businesses on the move. Equipped for WiFi and 5G connectivity, these devices accept a full range of payments including credit, debit, EBT, gift cards, and checks. The “store-and-forward” feature ensures transactions are saved even when there’s no signal—giving you peace of mind wherever business takes you. It’s perfect for food trucks, service providers, and vendors who need flexibility without sacrificing reliability.

Stand Alone Terminals

Our stand-alone terminals offer a straightforward, dependable way to accept payments without the need for a full POS system. Designed for businesses that want simplicity, these terminals support a wide range of payment types including chip cards, contactless payments, and more. With options for wireless or ethernet connectivity and easy integration into your existing setup, our terminals provide secure, fast, and efficient transaction processing for any business environment.

E-Commerce & Virtual Terminals

Expand your reach and take payments online with our e-commerce and virtual terminal solutions. Whether you run a full online store or need a way to invoice customers remotely, we provide secure tools to process credit card transactions over the web. Our virtual terminals allow you to key in payments from any device with internet access, offering flexibility and efficiency without needing physical hardware. It’s ideal for service-based businesses, remote teams, and digital retailers.

Zero Cost Processing

Our Zero Cost Processing program helps businesses save money by offsetting credit card processing fees through legal and compliant methods. Using either a Cash Discount or Surcharge Program, you can build the cost of processing into your pricing or pass a small fee directly to customers who choose to pay with cards. This innovative approach reduces your overhead while maintaining transparency with customers—and it’s fully compliant with current regulations.

Agent and ISO Program

If you’re a sales agent or ISO in the merchant services industry, our Agent and ISO Program is built to help you succeed. We offer the support, tools, and resources you need to close deals faster, retain more clients, and scale your business. With competitive payouts, real-time reporting, marketing materials, and access to industry-leading payment solutions, you and your merchants become part of a team committed to shared success. Join us and start growing today.

Comprehensive Payment Solutions: Revolutionizing Payment Processing for Modern Businesses

In today’s competitive business environment, effective payment processing serves as the foundation for operational success. Modern enterprises require sophisticated Point of Sale (POS) systems that transcend basic transaction handling, delivering seamless experiences that drive sustainable growth and exceptional customer satisfaction. Through advanced Clover POS technology and innovative cloud-based solutions, businesses can revolutionize their approach to card payments and unlock unprecedented operational efficiency.

At Good Payments Merchant Services, we understand that your payment infrastructure represents more than simple transaction processing—it’s the gateway to enhanced customer relationships and business expansion. Our comprehensive suite of solutions empowers businesses across all industries to streamline operations, reduce costs, and maximize revenue potential through cutting-edge payment technology.

Key Takeaways:

- Strategic Payment Infrastructure: Modern payment processing serves as the cornerstone of successful business operations, with sophisticated Point of Sale (POS) systems transforming how organizations handle card payments through advanced cloud-based solutions.

- Comprehensive Business Integration: Effective payment infrastructure extends beyond transaction processing, creating seamless customer experiences that drive measurable growth and satisfaction through solutions like the Clover Family and CardPointe Suite.

- Technology-Driven Operations: Successful businesses implement comprehensive payment processing strategies that leverage cutting-edge technology to streamline financial operations through wireless terminals, mobile solutions, and e-commerce platforms.

- Versatile Clover Solutions: The Clover POS family offers scalable business management solutions, including Station, Mini, Flex, and Go variants, each featuring robust integration capabilities and extensive app marketplace advantages.

- Enterprise-Level Analytics: CardPointe Suite delivers sophisticated payment intelligence through advanced reporting features, multi-location management capabilities, and enhanced security protocols designed for enterprise compliance requirements.

- Competitive Service Excellence: Good Payments Merchant Services provides transparent pricing structures, comprehensive 24/7 customer support, and customized industry-specific solutions, establishing trusted partnerships that drive business transformation.

- Future-Ready Growth: Comprehensive payment solutions enable businesses to achieve sustainable growth, enhance customer satisfaction, and maintain competitive advantages through strategic partnerships with experienced payment processing providers.

From Cash Registers to Cloud Solutions: The Paradigm Shift in Payment Processing

The evolution from traditional cash registers to sophisticated cloud-based solutions represents a fundamental transformation in business operations. Legacy systems no longer meet the complex demands of modern commerce, where Clover POS technology delivers integrated payment processing capabilities that streamline operations while enhancing customer experiences.

Research demonstrates that businesses adopting digital payment processing solutions experience revenue increases of up to 15%, while 80% of organizations utilizing cloud-based solutions report significant improvements in customer satisfaction. This paradigm shift toward integrated Point of Sale (POS) ecosystems provides measurable advantages over traditional payment methods.

The decline of traditional payment systems

Traditional payment infrastructure, including standalone cash registers and basic terminals, lacks the flexibility and functionality required for contemporary business success. These legacy systems often cannot process contactless card payments or integrate with e-commerce platforms, limiting opportunities for seamless customer experiences. In contrast, modern Clover POS solutions offer comprehensive feature sets and integrations that optimize operations while improving customer satisfaction.

Furthermore, traditional systems require substantial maintenance investments, with businesses spending up to $1,000 annually on hardware and software updates. Cloud-based solutions provide cost-effective, scalable alternatives through pay-as-you-go pricing models and automatic software updates, reducing operational expenses while improving bottom-line performance.

Why integrated payment ecosystems are vital

Integrated payment ecosystems deliver essential infrastructure for seamless customer experiences by consolidating transaction processing, inventory management, and sales tracking within unified platforms. Research indicates that businesses utilizing integrated payment processing systems reduce processing costs by up to 20%, while 90% report enhanced customer satisfaction metrics.

These ecosystems provide advanced security features, including tokenization and encryption, protecting sensitive customer information while ensuring compliance with industry standards. Real-time reporting and analytics capabilities enable data-driven decision-making, helping businesses identify improvement opportunities and optimize performance across all operational areas.

Integrated Point of Sale (POS) ecosystems also deliver competitive advantages through innovative features like mobile payment processing and e-commerce platform integration. By adopting comprehensive payment solutions, businesses can maintain market leadership while providing convenient, seamless customer experiences across all interaction channels.

Clover POS: A Versatile Approach to Business Management

Clover POS distinguishes itself through exceptional versatility and comprehensive product ranges designed for diverse business requirements. Whether supporting small startups or established enterprises, Clover offers customizable solutions that address specific operational needs. The Clover Station provides full-service countertop functionality with robust features including inventory management, employee tracking, and customer engagement tools, making it ideal for businesses requiring reliable, efficient daily operations management.

The Clover POS ecosystem’s integration capabilities represent a significant advantage, with the Clover App Market providing access to diverse tools and services that customize payment processing experiences. Applications like Clover Online Ordering enable seamless online order management, while Clover Rewards creates comprehensive loyalty programs that encourage repeat customer engagement and drive revenue growth.

Exploring Clover Station’s full-service capabilities

Clover Station delivers comprehensive business management through robust, reliable payment processing infrastructure. Its full-service capabilities enable seamless inventory management, employee hour tracking, and customer engagement within unified platforms. Users can create and manage inventory items, monitor stock levels, and receive automated low-stock alerts, while simultaneously tracking employee schedules and analyzing sales performance metrics.

The system’s customer engagement features support personalized experiences through customer profile management, purchase tracking, and targeted promotion capabilities. Integration options with accounting software and customer relationship management (CRM) tools provide additional operational efficiency, creating comprehensive business management ecosystems that support growth and scalability.

The practicalities of Clover Mini and Clover Flex

Clover Mini and Clover Flex address mobility and space requirements for businesses needing compact, versatile payment processing solutions. Clover Mini’s compact design accommodates limited counter space environments while maintaining powerful functionality, while Clover Flex’s handheld design enables tableside service and mobile payment processing capabilities. Both devices provide comprehensive features including transaction processing, inventory management, and customer engagement tools.

These mobile solutions excel in portability and ease of use, supporting off-site operations like events, pop-up shops, and mobile service delivery. Their comprehensive feature sets enable inventory tracking, employee management, and customer profiling, ensuring businesses maintain operational efficiency regardless of location. Whether processing payments at temporary events or providing tableside service, these solutions deliver professional card payments processing with complete business management capabilities.

Clover Go: Empowering portable payment processing

Clover Go transforms smartphones into comprehensive payment processing terminals, delivering ultimate portability for mobile businesses. This solution enables payment processing, inventory management, and customer engagement through single-device functionality, making it ideal for food trucks, delivery services, and mobile vendors requiring flexible, reliable payment solutions.

The application’s intuitive design simplifies deployment—users download the Clover Go app, pair with compatible card readers, and immediately begin processing transactions. Advanced features including inventory management, customer profiling, and sales tracking ensure comprehensive business management capabilities regardless of operational location, supporting efficient service delivery while maintaining professional card payments processing standards.

Harnessing Data: Unlocking Payment Insights with CardPointe

CardPointe delivers sophisticated analytics and reporting capabilities that transform raw transaction data into actionable business intelligence. Advanced reporting features provide comprehensive insights into customer spending patterns, transaction trends, and operational performance metrics, enabling data-driven decision-making that optimizes business efficiency and drives revenue growth.

These analytical capabilities extend beyond basic transaction reporting, offering predictive insights that help identify cost-saving opportunities and process improvements. Real-time transaction monitoring, security threat detection, and automated alert systems provide proactive business protection while ensuring operational continuity and customer trust.

Advanced analytics for better financial decision-making

CardPointe’s analytical framework supports strategic financial decision-making through comprehensive data insights and customizable reporting options. Key analytical benefits include:

- Real-time transaction monitoring and reporting – Immediate visibility into all payment activities

- Customizable dashboards – Tailored insights for specific business requirements

- Drill-down analysis capabilities – Detailed examination of transaction patterns and trends

- Automated alert systems – Proactive notifications for unusual activity or significant changes

- Predictive analytics – Forward-looking insights that support strategic planning

- Customer behavior analysis – Deep understanding of purchasing patterns and preferences

- Performance benchmarking – Comparative analysis against industry standards and historical performance

| Analytics Feature | Business Benefit |

| Transaction Tracking | Real-time monitoring of sales, refunds, and chargeback activities |

| Customer Intelligence | Comprehensive analysis of spending habits, preferences, and loyalty engagement |

| Revenue Analytics | Detailed revenue tracking with forecasting capabilities |

| Security Monitoring | Proactive fraud detection and risk management |

Navigating multi-location management with ease

Multi-location businesses face complex challenges managing payment processing, inventory, and customer data across distributed operations. CardPointe’s multi-location management capabilities provide centralized oversight through unified dashboards that consolidate operational data from all business locations. This comprehensive visibility enables informed decision-making, operational optimization, and consistent growth strategies across entire business networks.

The platform supports flexible location setup, customizable user permissions, and location-specific reporting while maintaining centralized control. This architecture ensures operational consistency while accommodating local requirements, enabling businesses to scale efficiently while maintaining service quality and operational standards across all locations.

Unleashing Mobility: The Future of Wireless Payment Solutions

Wireless payment processing solutions represent the future of business transactions, providing unprecedented mobility and operational flexibility. As mobile businesses continue expanding, demand for reliable, flexible payment solutions intensifies. Bluetooth and Wi-Fi-enabled terminals like Clover POS devices offer unparalleled convenience, enabling businesses to process card payments anywhere, anytime, without traditional terminal constraints.

This mobility revolution opens new opportunities for service-based and mobile businesses, including food trucks, event vendors, and delivery services. Real-time transaction monitoring and management capabilities ensure businesses maintain oversight of sales activities while making data-driven decisions that drive growth and customer satisfaction, regardless of operational location.

The advantages of Bluetooth and Wi-Fi-equipped terminals

Bluetooth and Wi-Fi technology integration creates seamless payment processing experiences that reduce customer wait times while increasing satisfaction levels. Restaurant businesses can process tableside payments through Bluetooth-enabled terminals, eliminating customer inconvenience while improving operational efficiency and service quality.

Wi-Fi-equipped terminals provide processing flexibility throughout business environments, requiring only stable internet connectivity. This capability particularly benefits multi-location businesses and non-traditional operational settings like outdoor events or temporary retail locations. Enhanced mobility capabilities expand business reach while creating new revenue opportunities through flexible service delivery models.

Ensuring mobile businesses thrive with cutting-edge technology

Mobile business success requires investment in advanced technology solutions that support dynamic operational requirements. Battery-powered processing capabilities enable card payments processing in locations without traditional power infrastructure, ensuring continuous service delivery regardless of environmental constraints. Food truck vendors and outdoor event operators can maintain professional payment processing standards without relying on external power sources or cumbersome backup systems.

These technological innovations enable mobile businesses to compete effectively in fast-paced markets while maintaining focus on exceptional customer experiences and sustainable growth. Data analytics integration provides insights into sales trends, operational improvements, and strategic optimization opportunities, ensuring mobile businesses can adapt quickly to market changes and customer preferences.

The Power of Standalone Terminals: Reliability Meets Affordability

Standalone terminals provide reliable, cost-effective payment processing solutions for businesses prioritizing simplicity and affordability. Countertop terminal solutions deliver efficient, secure transaction processing through PIN pad integration and customer-facing displays. Popular models like the Verifone VX 520 offer exceptional durability and reliability in high-volume environments, processing up to 100 transactions hourly for busy retail and restaurant operations.

Cost-effectiveness represents a significant advantage, with terminals like the Ingenico Desk/5000 available for one-time fees ranging from $200-$300, depending on supplier and feature requirements. This upfront investment eliminates monthly rental fees and long-term contract obligations while providing compatibility with multiple payment processors, ensuring businesses maintain flexibility in selecting optimal processing partnerships.

Countertop solutions for established businesses

Established businesses benefit from reliable countertop terminal solutions that provide convenient, secure transaction processing capabilities. Advanced terminals like Clover POS Mini or Pax S300 offer sophisticated features including contactless payment processing and integrated receipt printing, designed to handle high-volume operations processing up to 200 transactions hourly while minimizing downtime and technical interruptions.

Terminal selection should align with specific business requirements. Restaurant and hospitality operations may prefer terminals with integrated ordering and inventory management features, such as the Clover POS Station, which offers comprehensive apps and integrations that streamline operations while enhancing customer service delivery. Strategic terminal selection optimizes payment experiences while driving measurable customer satisfaction improvements.

Cost-effective options that don’t compromise on quality

Standalone terminals like the Dejavoo Z11 provide exceptional value through competitive upfront costs without sacrificing performance or reliability. Energy-efficient designs reduce long-term operational expenses, with models like the Verifone VX 680 utilizing advanced power management technology to minimize energy consumption while supporting environmental sustainability initiatives.

Payment processors offer competitive pricing and transparent fee structures for standalone terminal solutions, typically ranging from 1.5% to 3.5% per transaction depending on processor selection and card types. Good Payments Merchant Services provides customized industry-specific solutions that optimize payment processing while reducing operational costs. Small retail businesses processing 500 monthly transactions can expect approximately $125 in monthly processing fees at 2.5% per transaction, representing significant savings compared to alternative processing solutions requiring long-term contracts or higher fee structures.

E-Commerce Evolution: Virtual Solutions for Every Business Model

E-commerce expansion requires adaptable payment processing solutions that accommodate unique business requirements and customer expectations. With online shopping representing over 11% of total retail sales according to US Census Bureau data, seamless, secure payment processing infrastructure becomes essential for digital marketplace success. Customers demand hassle-free checkout experiences while businesses require reliable, efficient transaction management systems.

Business model diversity requires customized payment solutions supporting physical products, digital services, and subscription offerings. Comprehensive e-commerce payment solutions enable online payment gateway integration, recurring billing management, and mobile-responsive checkout experiences. Companies like Netflix and Spotify demonstrate successful recurring billing implementation, achieving significant revenue growth and enhanced customer retention through strategic payment processing optimization.

Integrating online payment gateways seamlessly

Online payment gateway integration simplifies through comprehensive payment solutions supporting popular gateways including PayPal, Stripe, and Authorize.net. Seamless website and mobile application integration enables diverse payment options including credit cards, debit cards, and alternative methods like Apple Pay and Google Pay, with businesses offering multiple payment options experiencing average sales increases of 25% according to PayPal research.

Advanced security features including tokenization and encryption protect sensitive payment information through unique token replacement and data protection protocols. Companies like Amazon implement robust security measures to safeguard customer payment information, building trust and confidence that encourage repeat transactions and customer loyalty development.

Exploring the benefits of recurring billing management

Recurring billing management transforms subscription-based businesses through automated payment processing, invoice generation, and customer communication systems. McKinsey research indicates that businesses implementing recurring billing models achieve average revenue increases of 30% while reducing churn rates by 25% through improved customer retention strategies.

Flexible payment plans and pricing models enhance customer satisfaction while providing opportunities for upselling and cross-selling through data-driven customer behavior analysis. Companies like Salesforce successfully leverage recurring billing models to achieve sustainable revenue growth and customer retention while reducing administrative overhead through automation.

Implementation of automated recurring billing systems reduces administrative costs by 40% while increasing customer satisfaction by 20% according to Forrester research. This operational efficiency enables businesses to focus on core growth activities and exceptional customer experience delivery while maintaining reliable, consistent revenue streams through optimized payment processing automation.

Conclusion

Comprehensive payment processing solutions provide transformative opportunities for businesses seeking operational efficiency and sustainable growth. Through strategic implementation of modern Point of Sale (POS) systems, cloud-based solutions, and advanced card payments processing technology, organizations can streamline operations while enhancing customer experiences and driving measurable business results.

Good Payments Merchant Services stands ready to partner with your organization, providing tailored payment solutions that address unique business requirements and growth objectives. Our comprehensive approach encompasses Clover POS systems, wireless and mobile solutions, and enterprise-level analytics that support informed decision-making and strategic business development.

Schedule a consultation with our payment processing experts to explore customized solutions that can revolutionize your business operations. Whether you’re upgrading existing Point of Sale (POS) infrastructure, expanding e-commerce capabilities, or simplifying financial operations, our team will help you implement solutions that drive success and position your business for sustainable growth in today’s competitive marketplace.

Frequently Asked Questions

Q: What constitutes comprehensive payment processing and how does it benefit modern businesses?

A: Comprehensive payment processing encompasses holistic transaction management that creates seamless customer experiences while driving business growth and satisfaction. This approach leverages innovative technologies including cloud-based solutions and integrated Point of Sale (POS) systems. Good Payments Merchant Services specializes in tailored payment solutions that address unique business requirements, ensuring efficient, secure, and scalable payment processing infrastructure.

Q: How do modern Point of Sale (POS) systems revolutionize business payment processing?

A: Modern Point of Sale (POS) systems like Clover POS transform business operations through sophisticated cloud-based solutions that integrate multiple operational aspects. These systems provide advanced features including real-time inventory management, customer relationship management, and detailed analytics, enabling data-driven decision-making that enhances customer experiences, streamlines operations, improves efficiency, and increases revenue through actionable business insights.

Q: What key components comprise comprehensive payment infrastructure for business success?

A: Comprehensive payment infrastructure includes secure payment processing, advanced reporting and analytics, multi-location management capabilities, and seamless integration with existing business systems. These components collaborate to provide efficient, scalable card payments processing solutions that improve customer satisfaction, reduce operational costs, and increase revenue while driving sustainable business growth and competitive market positioning.

Q: How does the Clover family support diverse business requirements and what benefits does each product offer?

A: The Clover POS family offers scalable solutions for businesses of all sizes and types. Clover Station provides full-service countertop functionality for larger operations, while Clover Mini delivers compact power for space-constrained environments. Clover Flex offers handheld mobility for tableside and mobile businesses, and Clover Go enables smartphone-based processing for ultimate portability. Each product features integration capabilities, app marketplace advantages, and advanced functionality tailored to specific business requirements.

Q: What advantages does CardPointe suite provide for enterprise-level payment intelligence?

A: CardPointe suite delivers advanced reporting and analytics features, multi-location management capabilities, and enhanced security protocols ideal for enterprise-level operations. The suite offers custom integration options that allow businesses to tailor solutions to specific operational requirements. Through CardPointe, enterprises gain valuable payment processing insights, streamlined operations, and improved security protocols that drive sustainable growth and operational excellence.

Q: How do wireless and mobile payment solutions benefit service-based and mobile businesses?

A: Wireless and mobile payment processing solutions provide service-based and mobile businesses with flexible transaction processing capabilities anywhere, anytime. These solutions offer real-time transaction monitoring and management, enabling businesses to maintain payment oversight while making informed decisions. Wireless and mobile solutions increase revenue opportunities, improve customer satisfaction, and reduce operational costs while supporting business growth and market expansion.

Q: What support does Good Payments Merchant Services provide for comprehensive payment solution implementation?

A: Good Payments Merchant Services offers comprehensive support including free consultations, needs assessments, and implementation timelines to help businesses adopt comprehensive payment processing solutions. Additional resources include training programs, ongoing partnership support, and customized industry-specific solutions. To learn more about our Point of Sale (POS) systems, Clover POS solutions, and cloud-based payment processing options, contact our team directly or visit our website to schedule a consultation and begin transforming your business payment infrastructure.